ECB’s Rate Hike Decision: A Dangerous Move for The Euro Zone Economy

- Posted on June 15, 2023

- News

- By Stiti pragnya padhy

- 210 Views

In a bid to combat high

inflation, the European Central Bank on Thursday implemented the highest raise

in borrowing costs despite the weakening euro zone economy for the first time

in 22 years.

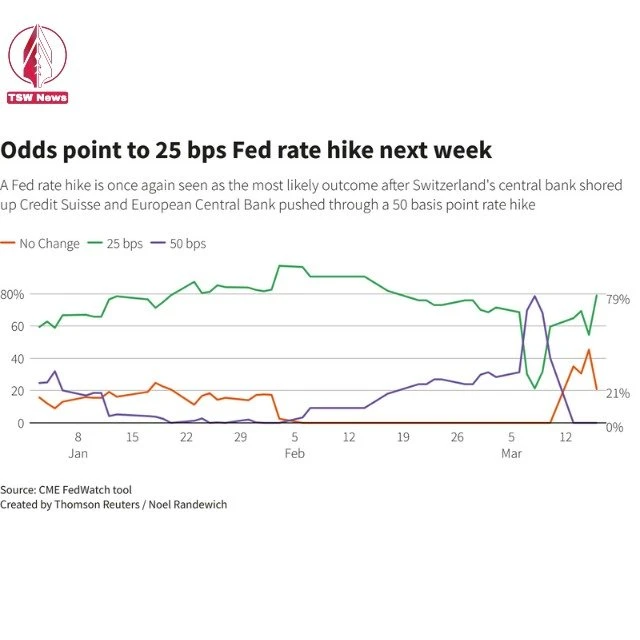

The ECB raised its key interest rate, which is paid by banks to securely deposit funds at the central bank, for the eighth consecutive occasion, increasing it by 25 basis points to 3.5%. This has been found to be the highest level since 2001. The central bank, which represents the 20 euro zone countries, predicted that inflation will remain above its 2% target until 2025.

The European Central Bank also

suggested that in the upcoming months, there is also a possibility of a further

increase in interest rates. It stated, "Future decisions will ensure that

the key ECB interest rates will be brought to levels sufficiently restrictive

to achieve a timely return of inflation to the 2% medium-term target and will

be kept at those levels for as long as necessary."

While inflation has been decreasing over the past few months, the economic growth of the euro zone is currently at best stagnating. This is happening due to lower energy prices as well as the sharpest interest rate hike in the 25-year history of the European Central Bank.

However, the inflation rate in

the euro zone, at 6.1%, remains excessively huge for the European Central Bank.

Furthermore, the underlying price growth, which usually excludes the components

of food and energy, has only begun showing signs of slowing. It reported,

“Staff have revised up their projections for inflation excluding energy and

food, especially for this year and next year, owing to past upward surprises

and the implications of the robust labour market for the speed of disinflation".

It is highly anticipated that ECB

President Christine Lagarde will open up the option of a future interest rate

hike in September. She is also expected to push back against investor

speculations that the central bank might cut rates in the early months of next

year.

For more updates keep visiting

our website www.topstoriesworld.com where we

provide unbiased, true and top stories of the world.